Key Figures

SF Urban Properties Ltdas at 31 December 2025

| Share Price CHF | 100.50 |

Description

SF Urban Properties Ltd (SFUP) is a Swiss real estate company based in Zurich. It invests in residential, commercial and development properties with a focus on the cities of Zurich and Basel. Its strategy is geared towards economic areas and locations that show more potential than others due to demographic, legal or economic conditions or their changes.

Company Data

| Company | SF Urban Properties Ltd |

| Legal form | Swiss Corporation (AG) |

| CEO | Bruno Kurz |

| CFO | Sascha Küng |

| Asset manager | Swiss Finance & Property Funds Ltd |

| Auditors | PricewaterhouseCoopers AG |

| Valuation expert | Wüest Partner AG |

| Market Maker | Swiss Finance & Property Ltd |

| Holding structure real estate | Direct property |

| Benchmark | REAL Index |

| Management fee | 0.71% (NAV); 0.5% > CHF 250 mn |

| SIX Swiss Exchange listing | 17 April 2012 |

| Portfolio value investment properties as at 30 June 2025 | CHF 800.7 mn |

| Security / ISIN number | 3281613 / CH0032816131 |

| Bloomberg code | SFPN SW Equity |

| Distribution for 2024 | CHF 3.65 |

| Distribution yield as at 31 December 2024 | 3.71% |

| Final distribution for the financial year 2024 | 16 April 2025 |

Market Value by Region (as at 30 June 2025)

Type of Usage (as at 30 June 2025)

Performance (reset on base 100)

Cumulative Performance (in %)

| YTD | 1 mt | 3 mts | 1 year | 3 years | 5 years | Since Inception | |

| SFUP | 6.20% | 2.13% | 4.25% | 6.20% | 27.11% | 24.97% | 104.88% |

| Benchmark | 23.31% | 2.32% | 7.80% | 23.31% | 55.86% | 47.96% | 174.89% |

Ratios

| Ratios on return and performance | Unit | 30 Jun. 2025 | 31 Dec. 2024 |

| Investment yield | % | 6.17 | 1.73 |

| EBIT margin investment properties excl. revaluation | % | 69.02 | 65.83 |

| Return on equity (ROE) excl. Revaluation | % | 3.84 | 3.32 |

| Distribution yield | % | n.a | 3.71 |

| Ratios on the financial markets | Unit | 30 Jun. 2025 | 31 Dec. 2024 |

| Premium | % | -14.39 | -11.72 |

| Share price | CHF | 98.00 | 98.40 |

| Ratios on the balance sheet | Unit | 30 Jun. 2025 | 31 Dec. 2024 |

| Market value of properties | CHF | 800 742 000 | 786 834 000 |

| Gross asset value | CHF | 893 999 000 | 873 207 000 |

| Net fund assets | CHF | 385 851 000 | 374 828 000 |

| Borrowing ratio | % | 56.84 | 57.07 |

| LTV (Loan-to-Value) | % | 47.37 | 47.39 |

| Ratios on the income statement | Unit | 30 Jun. 2025 | 30 Jun. 2024 |

| Rental income | CHF | 15 928 000 | 15 570 000 |

| Total operating income before revaluations | CHF | 31 969 000 | 23 988 000 |

| Ratios on the units | Unit | 30 Jun. 2025 | 31 Dec. 2024 |

| Net asset value | CHF | 114.47 | 111.47 |

| Distribution per unit | CHF | n.a | 3.65 |

| ‒ of which free of withholding tax | CHF | n.a | 3.65 |

| Units at end of reporting period | pc. | 3 351 930 | 3 351 930 |

| Ratios on the portfolio | Unit | 30 Jun. 2025 | 31 Dec. 2024 |

| Number of investment properties | pc. | 49 | 50 |

| Number of development properties | pc. | 6 | 5 |

| Gross yield | % | 4.03 | 4.15 |

| Real discount rate | % | 2.72 | 2.78 |

| Nominal discount rate | % | 3.75 | 4.06 |

| Vacancy rate as at reporting date | % | 1.98 | 1.36 |

| WAULT in years | years | 4.30 | 4.00 |

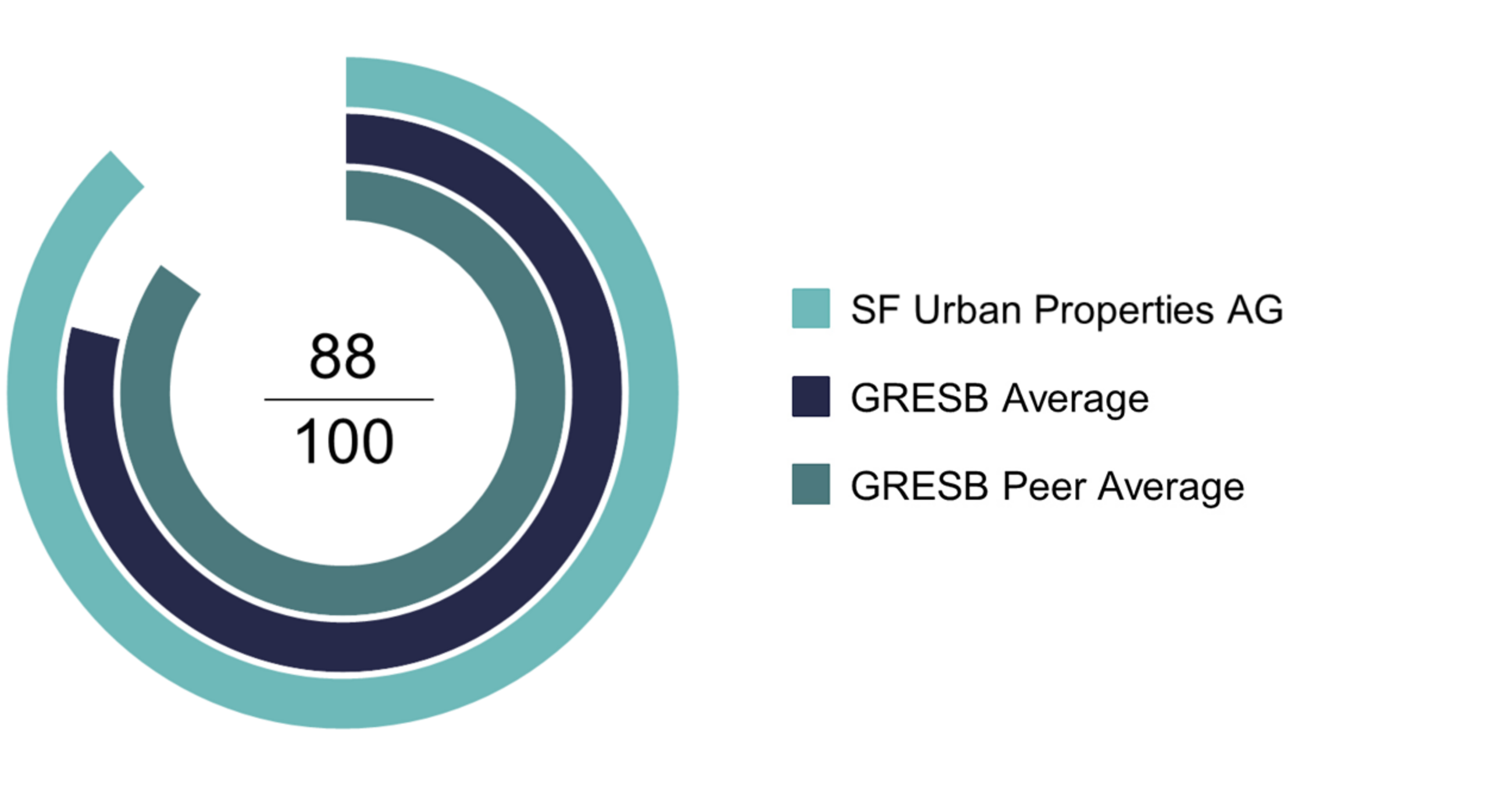

GRESB Rating

| GRESB Rating Standing Investment | ★★★★ |

| GRESB Score Standing Investment | 88 out of 100 |

| GRESB Average | 79 out of 100 |

| GRESB Peer Average | 85 out of 100 |

GRESB Portfolio Summary

Source: GRESB

All intellectual property rights to this data belong exclusively to GRESB B.V. All rights reserved. GRESB B.V. has no liability to any person (including a natural person, corporate or unincorporated body) for any losses, damages, costs, expenses or other liabilities suffered as a result of any use of or reliance on any of the information which may be attributed to it.

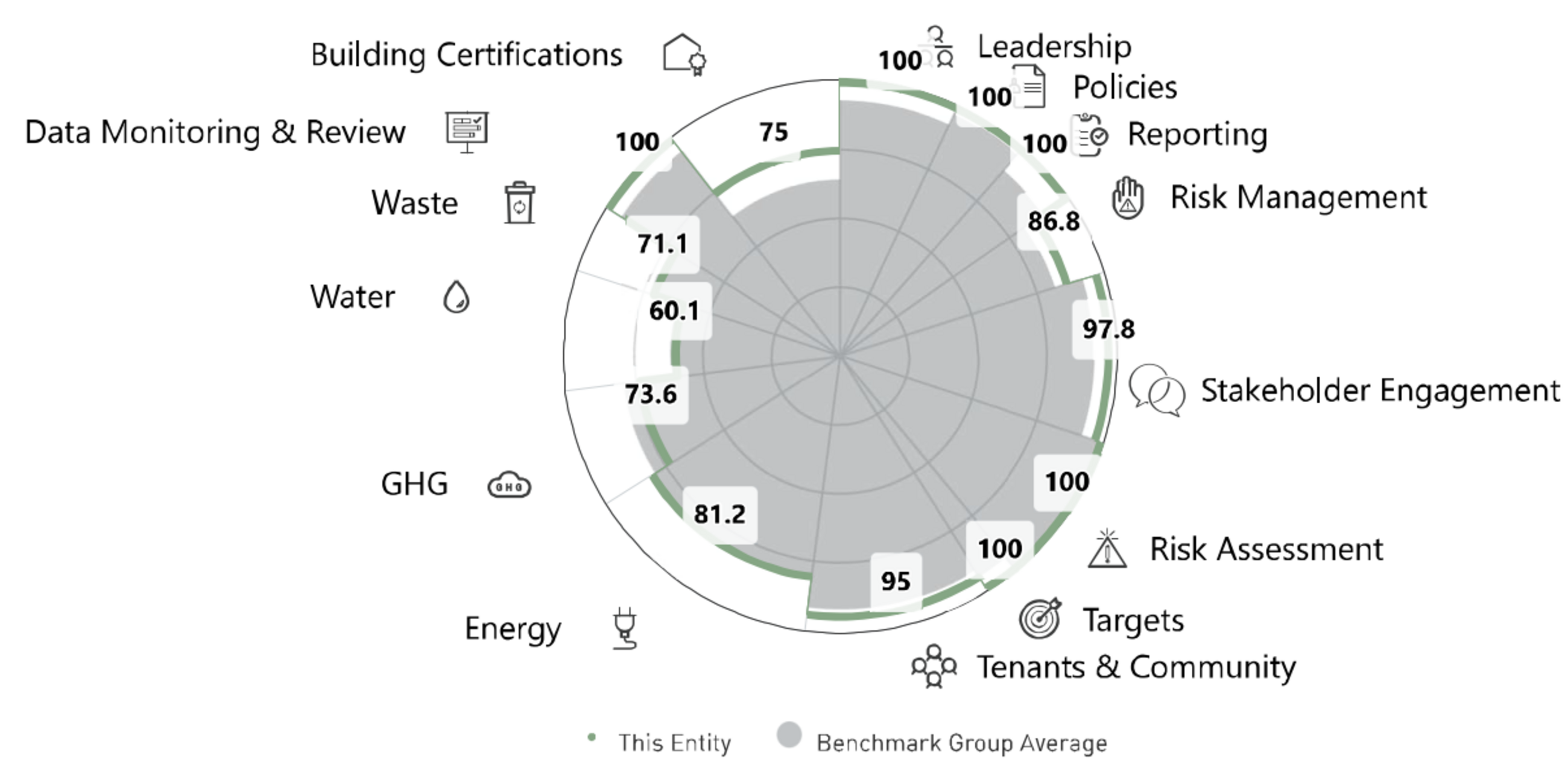

GRESB ESG Breakdown

Source: GRESB

The information in the factsheet linked below is relevant.